The Best New Crypto Exchanges in 2024

Best New Crypto Exchanges in 2024

Review of Our Top 10 New Crypto Exchanges Sites

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

- futures trading 12

- Bitcoin

- Ethereum

- Binance Coin 291

- Sepa

- GiroPay

- Visa 305

- English

- Indonesian

- Spanish 22

- France

- Italy

- Lithuania 13

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

- Korean 15

- Blog

- News

- Announcements 1

2. Blockchain.com

- €0.50 - $25

- spot trading

- margin trading

- staking 3

- Bitcoin

- Ethereum

- Bitcoin Cash 28

- Bank transfer

- Sepa

- Faster Payments 49

- English

- Spanish

- Portuguese 2

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

3. LBank

- 1750

- spot trading

- derivatives trading

- futures trading 5

- Ethereum

- Terra

- Polygon 241

- Visa

- MasterCard

- Bank transfer 255

- English

- Russian

- Spanish 27

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

- Polish 24

- Academy

- Guides

- Videos

4. Binance TR

- 0.0002

- spot trading

- wallet

- Holo

- Internet Computer

- The Graph 80

- Bank transfer

- Ziraat Bankasi

- VakifBank 84

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

- futures trading 3

- BitMEX Token

- Bitcoin

- TRON 8

- Visa

- MasterCard

- ApplePay 12

- English

- Russian

- Turkish 1

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

- futures trading 9

- SHIBA INU

- Wrapped Dogecoin

- ADAX 191

- Visa

- MasterCard

- Bank transfer 110

- English

- Russian

- Turkish 14

- Seychelles

- Estonia

- Switzerland 2

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

- Vietnamese 5

- Videos

- Learn and Earn

- Blog 2

7. Okcoin

- 3.99%

- spot trading

- OTC trading

- staking 1

- Bitcoin

- Ethereum

- Tether 101

- Visa

- MasterCard

- ApplePay 107

- English

- United States

- Canada

- United Kingdom 26

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

- Videos 1

8. OKX

- Free

- spot trading

- derivatives trading

- perpetual swaps trading 9

- Tether

- Bitcoin

- Litecoin 92

- Bank transfer

- Visa

- MasterCard 344

- English

- Chinese (Mandarin)

- Simplified Chinese 14

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

- perpetual contracts trading 8

- Ethereum

- Cardano

- Chainlink 231

- SwiftCash

- Bank Transfer (ACH)

- Sepa 308

- English

- Russian

- Japanese 6

- 2FA Google Authenticator

- English

- Japanese

- German 2

- Blog

- Videos

- Academy 4

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

- futures trading 7

- APENFT

- Bitcoin

- Ethereum 363

- Bank transfer

- Visa

- MasterCard 366

- English

- Chinese (Mandarin)

- Simplified Chinese 9

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

You May Also Like

Overview of the The Best New Crypto Exchanges in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

How to Choose a New Crypto Exchange

Choosing the right crypto exchange is a key decision you will make. It can influence your trading experience and security.

In this article, I'll walk you through all the considerations and key factors you should keep in mind.

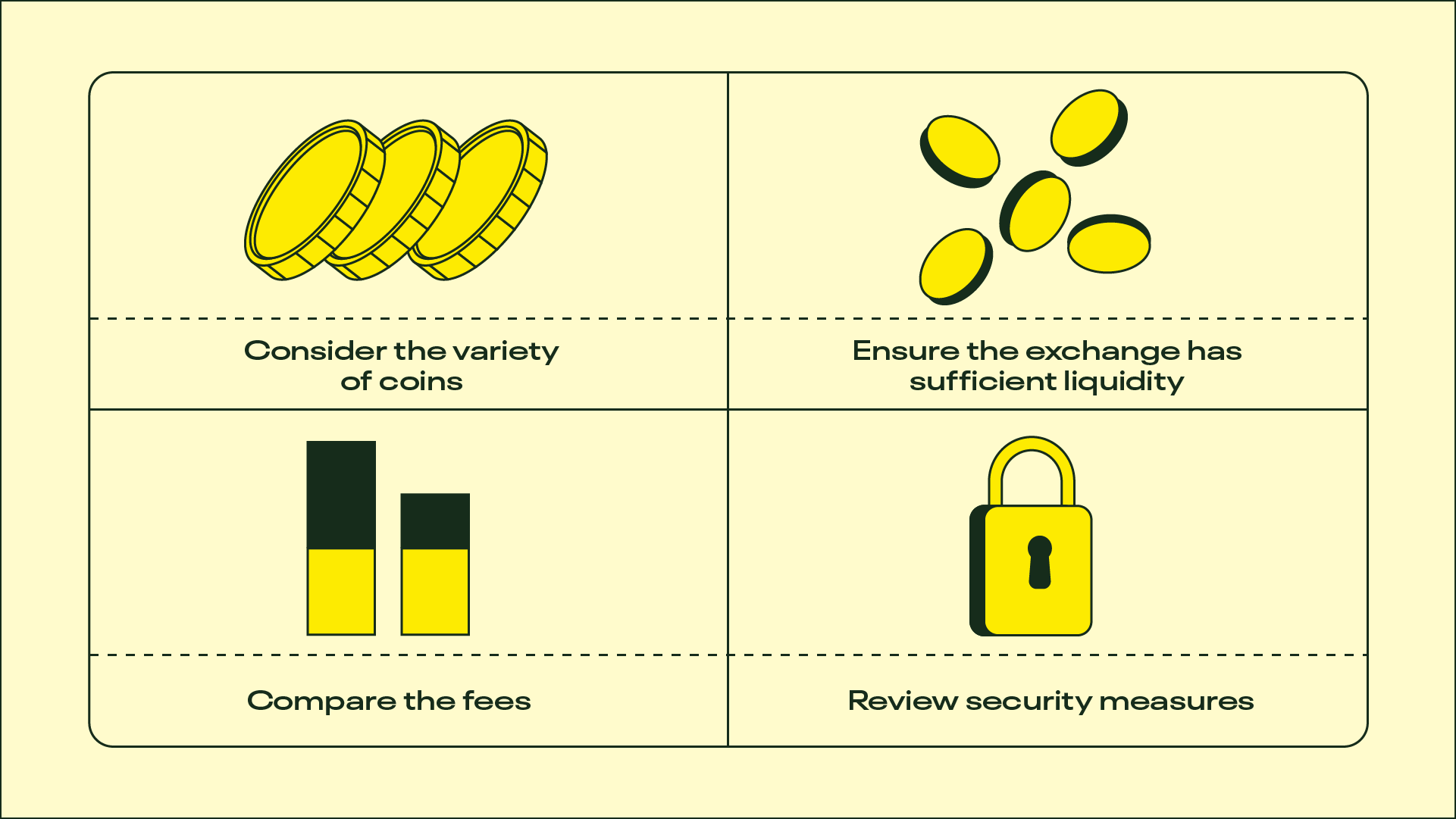

Consider the Variety of Coins Offered

Cryptocurrency trading can be intricate. Luckily, crypto exchanges simplify the process. With many different coins available, selecting the right exchange is crucial.

Not all exchanges support every digital asset. Make sure to check if they offer the ones you want. You can expect to find a range of the most prominent cryptos such as:

- BTC

- ETH

- SOL

- ADA

- DOGE

Look through the list to see if your preferred altcoin is available on the trading platform.

Remember, some exchanges may ease trading for many obscure coins. Yet, they might not follow U.S. laws or regulations.

Ensure the exchange has liquidity

Liquidity holds significance in the crypto realm. It shows how you can convert your cash into coins.

During times of volatile prices, swift trades are essential. Check the exchange's trading volume. The higher, the better.

Compare the fees

Crypto exchanges impose fees for depositing, trading, and withdrawing. Fees can range from 0% to 5% per trade, depending on your trading volume.

Some fees depend on your cumulative trading volume over a 30-day period. Larger trades often include lower fees.

Review Security Measures

Crypto exchanges are susceptible to hacks. This is why security is paramount. Most exchanges offer fundamental safeguards, like two-factor authentication (2FA). Some even incorporate biometric logins involving facial or fingerprint recognition.

Seek out exchanges with robust security protocols and financial audits in place. Look for Service Organization Control (SOC) reports. These show that the exchange's financial and technological systems are in great condition.

The website should also employ a Secure Sockets Layer (SSL). That’s a small padlock icon you see next to the URL.

Additionally, verify the platform's licenses. Review other documentation about security. If these documents are hard to locate, consider alternative options.

Educational resources

When choosing a new crypto exchange, it's essential to check its educational materials. These resources are vital for users to make informed decisions. Access to these resources empowers you with more confidence.

The crypto space has its unique set of risks. Understanding the risks involved allows users to take precautions to safeguard their investments.

Types of educational resources

- Crypto Basics: Seek out resources that cover fundamental crypto concepts. This includes blockchain technology, Ethereum, and more.

- Trading Strategies: Educational materials on trading strategies are highly beneficial. They assist users in maximizing gains, and minimizing risks.

- Market Analysis: Get access to market analysis and insights. Look for resources that offer comprehensive analyses of crypto trends.

- Variety of Formats: Educational resources come in various formats. You will usually see blogs, guides, help centers, or simulation trading platforms. Some platforms even offer instructive videos and an "Academy" section.

Licenses and geographic restrictions

Certain countries, including the United States, categorize specific cryptocurrencies as securities. They are subject to the same regulatory standards as conventional securities. For instance, the U.S. SEC oversees Initial Coin Offerings (ICOs) as offerings of securities.

In Europe, state authorities and regulatory bodies maintain strict oversight over crypto exchanges.

In Singapore and The Bahamas, unique licenses are in place for crypto. These licenses legitimize crypto exchanges and trading activities.

Singapore treats Bitcoin like a tradable commodity. It is subject to taxation similar to Goods and Services Tax (comparable to VAT).

In countries like Algeria and Morocco, cryptocurrencies are outright banned. Their use and possession are illegal.

Many countries have implemented Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations mandate that exchanges identify and verify their users.

A crypto license serves as the legal authorization for operating a cryptocurrency exchange. Utilizing an unlicensed exchange is a risky endeavor!

What offerings and features does the exchange provide?

When picking a new crypto exchange, it's crucial to explore its features. Understanding these offerings is fundamental for making an informed decision.

Trading platforms and tools

Exchanges offer a range of trading tools for different types of traders. Some provide user-friendly platforms suitable for beginners. Others cater to professional traders.

These platforms are equipped with customizable chart analysis tools. They offer in-depth order book insights and high-speed order execution. Select a trading site that aligns with your trading experience and goals.

Spot, margin, and futures trading

Exchanges may offer various types of trading, including spot, margin, and futures trading.

Spot trading involves immediate buying and selling of cryptocurrencies.

Margin trading allows experienced traders to leverage their positions. This brings increased profits, but it also carries a risk of losses.

Futures trading entails contracts to buy or sell assets at a fixed price in the future. It provides a way to hedge against market fluctuations.

Crypto wallets and storage options

Security is paramount in the world of cryptocurrency. When choosing an exchange, explore the available wallet options.

Some exchanges offer secure self-hosted crypto wallets. These give you full control over funds. Others provide custodial wallets. With those, the exchange manages your assets on your behalf.

Services for individuals

Ethereum exchanges offer a wide array of services for individuals. You can buy and sell a variety of cryptocurrencies on these platforms. You can also build and manage your portfolio, and receive crypto rewards.

Additionally, some exchanges allow borrowing fiat currency using your Ethereum holdings as collateral.

DeFi and staking

A new crypto platform might offer lending and staking services. These can serve as your savings accounts within the crypto market. You can choose to stake or lend a specific amount of currency to earn interest.

Additionally, you may have access to loans if the exchange provides this service. Ensure there is some form of insurance on your holdings. Review the fee structure for earnings and returns.

Services for businesses

Certain exchanges offer institutional solutions tailored to the needs of larger organizations. You can list your digital asset on the exchange to enhance exposure and liquidity.

Additionally, some exchanges provide access to the futures market for effective risk management.

Trading bots

Newer exchanges may introduce features like trading bots. Trading bots can execute trading strategies based on predefined rules and market conditions.

Incorporating trading bots into your strategy can offer a competitive advantage.

NFT support

With the increasing popularity of NFTs , newer exchanges may integrate NFT marketplaces. This feature allows users to explore, create, buy, and sell NFTs.

Mobile app

Recognizing the importance of mobile accessibility, many new crypto exchanges offer mobile apps. These apps enable users to trade and manage their portfolios on the go. They offer flexibility to stay connected to the crypto market no matter where you are.

Which payment options are available?

Curious about the payment methods accepted on a new exchange? Understanding your payment options is key to successful transactions. Here are some avenues to consider:

PayPal

PayPal is a convenient tool for handling crypto transactions. It can help you manage depositing, storing, sending, and withdrawing funds. PayPal provides an added layer of security through two-factor authentication. This improves the security of your assets.

Credit card or debit card

Credit cards hold extensive acceptance in the exchange ecosystem. They offer a straightforward means of utilizing funds directly from your bank account. Debit cards are also a great choice, and they're enough to improve the safety of your transactions.

Bank transfer or wire transfer

Bank transfers can be a favorable option, particularly in regions where credit cards may not be as prevalent. The bank transfer process happens instantaneously. It enables you to engage in trading or investing with minimal delay.

Banks are esteemed for their reliability, instilling confidence when managing your finances.

Digital tokens

Cryptocurrencies serve as the predominant payment method on crypto platforms. These tokens offer distinct advantages, including decentralization and robust cryptography.

Transactions can be conducted while maintaining anonymity. This feature is valued by many users for its control and privacy.

Various Categories of New Crypto Exchanges

Navigating the realm of cryptocurrency exchanges is like selecting a mode of transportation. There are diverse platforms tailored to meet your requirements.

Each presents its own set of merits and drawbacks. Let's embark on a journey through the key categories:

Centralized exchanges (CEXs)

These are similar to the conventional showrooms of the crypto universe. You've likely encountered prominent names like Coinbase and Binance. Here's a breakdown of CEXs:

Pros

- User-friendly: CEXs tend to be more accessible for novices.

- Liquidity: They typically boast higher trading volumes.

- Customer support: They often offer robust support for inquiries and concerns.

Cons

- Vulnerable to attacks: Your assets are under the exchange's custody. These are susceptible to hacking.

- Privacy: Due to regulatory requirements, they often demand substantial personal information.

- Fees: Transaction and trading fees can accumulate over time.

Decentralized exchanges (DEXs)

Picture DEXs as the DIY approach to crypto trading. They resemble those customized vehicles seen in movies - a bit more hands-on.

Pros

- Control: You have direct authority over your assets, eliminating intermediaries.

- Privacy: There's not always a necessity to disclose your identity.

- Security: As your assets remain under your purview, they're less exposed to potential threats.

Cons

- Learning curve: They can pose challenges for beginners.

- Liquidity: Smaller trading volumes may imply reduced liquidity. This is making it harder to conduct large trades.

- Lack of support: In the event of an error, there's often no customer assistance available.

Hybrid Exchanges (HEXs)

These represent a fusion of CEX and DEX attributes, striving to blend user-friendliness with autonomy.

Pros

- Balances ease and control: You attain a degree of asset control without encountering a steep learning curve.

- Privacy alternatives: Certain hybrids offer privacy-centric features.

- Liquidity: They frequently feature respectable levels of liquidity.

Cons

- Not entirely decentralized: They may not offer the same level of authority as a pure DEX.

- Fees: Transaction fees may still be a factor.

Each exchange category caters to distinct preferences and objectives. Think about your preferences and goals when making your crypto exchange selection.

You've Chosen a New Crypto Exchange, What's Next?

Congratulations on embarking on your journey!

Now that you've taken this step, let's make sure your crypto experience starts on the right track.

Here's a step-by-step guide on what to do next:

Safeguard your account

Crypto exchanges provide security. Still, it's not recommended to keep all your crypto there. Consider moving a significant portion to a more secure cold wallet (offline wallet).

Think of this cold storage as a virtual vault for your digital assets. Its role is to safeguard money from online threats.

Remain vigilant against scams

The crypto landscape can be a bit unpredictable. Unfortunately, scams are not uncommon. Exercise caution with offers that appear too good to be true. Always double-check the legitimacy of projects and investment opportunities.

Be on the lookout for phishing attempts. Scammers employ fake emails or create deceptive websites to steal your login details or private keys. Always verify the source and refrain from sharing sensitive information through unsecured channels.

Diversify your portfolio

If you haven't already, consider diversifying your crypto holdings. Spread your investments across various cryptocurrencies to help mitigate risk.

Take the time to explore and research new cryptocurrencies beyond Bitcoin and Ethereum. Some promising projects may present excellent investment opportunities.

Stay well-informed

The cryptocurrency markets are incredibly dynamic. Keep a close watch on market trends, price fluctuations, and the emergence of new coins. Staying informed empowers you to make well-informed decisions about buying or selling.

Additionally, be aware that crypto regulations can vary from one region to another. Staying updated ensures compliance and safeguards your investments.

FAQs

How can I determine the most suitable cryptocurrency exchange for my needs?

Selecting the right cryptocurrency exchange can be challenging. Account for factors such as fees, security protocols, and customer support quality. Read user reviews, compare fee structures, and check security measures.

Who holds authority over cryptocurrency exchanges?

The authority overseeing a cryptocurrency exchange depends on the exchange’s classification. In the case of centralized exchanges, the exchange itself assumes primary control. It sets forth the exchange’s rules, regulations, and fee structures. It manages the security framework of the platform.

What advantages come with utilizing a cryptocurrency exchange?

Cryptocurrency exchanges are a protected space for the buying and trading of digital assets. Users can access many digital currencies. This involves major coins such as Bitcoin, Ethereum, and Litecoin. Additionally, these platforms present an array of features that improve trading.

What risks accompany the use of a cryptocurrency exchange?

The risks associated with cryptocurrency exchanges are security risks and operational risks. Security risks pertain to the vulnerability of the exchange platform itself. They encompass the potential for fund theft, hacking incidents, and fraudulent activities. Operational risks involve changes that occur within the operational framework of the company.

Where can I locate a reputable cryptocurrency exchange?

It is crucial to seek out an exchange that adheres to regulatory standards. It should also comply with the laws of the country in which you are situated. Look for exchanges with solid reputations and a strong presence.

.png)